We will have an informational meeting prior to the Planning & Zoning and Board of Aldermen meetings regarding the Use Tax that will be on the April 6th ballot for the City of Rogersville. Please join us at City Hall 211 E. Center St. Rogersville, MO 65742 at 5:30pm on 2/23/21, 3/1/21, 3/9/21, 3/15/21, 3/23/21, and 4/5/21.

Ballot Language

Amendment A

Shall the City of Rogersville, Missouri impose a local use tax at the same rate as the total local sales tax rate, currently 2.25%, provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action? A use tax return shall not be required to be filed by persons whose purchases from out-of-state vendors do not in total exceed two thousand dollars in any calendar year.

If this questions is approved, the City of Rogersville would begin collecting a use tax from sales made to Rogersville buyers by online and out of state vendors that are not currently taxed. The funds derived from the use tax will fund municipal costs and expenses including police safety, infrastructure, transportation, capital improvements, and parks and recreation.

Local Use Tax Fast Facts

A local use tax is applied instead of a local sales tax on goods purchased from certain online and out-of-state sellers for delivery and use in Rogersville.

- The use tax rate will always be the same as Rogersville's sales tax rate (2.25%).

- A buyer will never pay both a local use tax and sales tax on the same transaction.

- It is estimated that a use tax would bring $50,000 back into our community per year.

Why Is a Use Tax Important for Rogersville?

Local sales tax revenues are declining due to a rise in e-commerce. The City relies heavily on revenues from local sales tax to fund basic services, such as street maintenance, police, Animal Control, codes and building safety. The increase in online shopping is compromising this traditional funding source, forcing the City to modernize its revenue sources in order to provide the essential services our residents expect.

Nationwide, e-commerce sales rose 14.9% in 2019 to $601.7 billion and represented 11% of total sales. Local sales tax cannot be collected for online, out-of-state purchases and can only be collected through a use tax.

A use tax helps local businesses. A local use tax would also place local businesses on equal footing with out-of-state vendors. Out-of-state vendors currently avoid local taxes, putting local businesses at a competitive disadvantage. A use tax would eliminate the disparity in tax rates collected by local and out-of-state sellers by imposing the same rate on all sellers.

How Does a Use Tax Work?

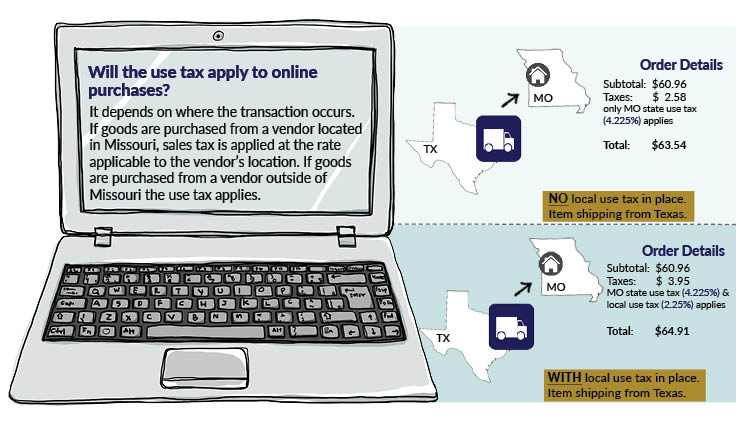

local use tax is applied instead of a local sales tax to goods purchased from certain online and out-of-state vendors for delivery and use in Rogersville.

A purchase would never be subject to both local sales tax and use tax.

- If goods are purchased at a Rogersville retail store, the City of Rogersville sales tax (2.25%) is applied.

- With a local use tax in place, if goods are purchased from an out-of-state vendor, a use tax (2.25%) would apply.

The local use tax must mirror the local sales tax.

- If the City's sales tax is decreased or increased by voter approval, the City's use tax rate also changes by the same action in order to remain the same.

Voter approval is required for the City to receive local use tax revenue on goods purchased for use locally from out-of-state vendors.

- In Missouri, 218 cities have a voter-approved use tax in place including Nixa, Kimberling City, Warsaw, Springfield, Kansas City and St. Joseph. Joplin and Webster Grove are asking voters to consider a use tax on the April 2021 ballot.

How Would Use Tax Revenue Be Used?

The Missouri Department of Revenue estimates that our community would receive $50,000 annually if a use tax was in place.

If this use tax was approved by voters.

Use tax revenue would support essential City services in the same manner as local sales tax. Services such as:

- Police, Animal Control, code enforcement, building inspections and snow removal

- Curb and pavement management programs

- Street and storm water capital projects

- Parks and Recreation